Best Secured Credit Cards Of 2025

Secured credit cards offer a valuable opportunity for individuals with limited or poor credit history to build or rebuild their credit profile. While these cards are widely available in the USA, options are more limited in the UK and European markets. Secured cards typically require a cash deposit as collateral, often equal to the card's credit limit, providing a safety net for lenders. In the UK and Europe, true secured credit cards are rare, with notable exceptions being the ZORRZ BlueAccess Card, a genuine secured credit card, and the ZILCH Mastercard, which functions more as a Buy Now Pay Later (BNPL) app. Both of these UK options are virtual cards. This website compares three secured cards each from the UK/European and USA markets, helping consumers make informed decisions about credit-building tools across different regions.

UK & EU Credit Cards

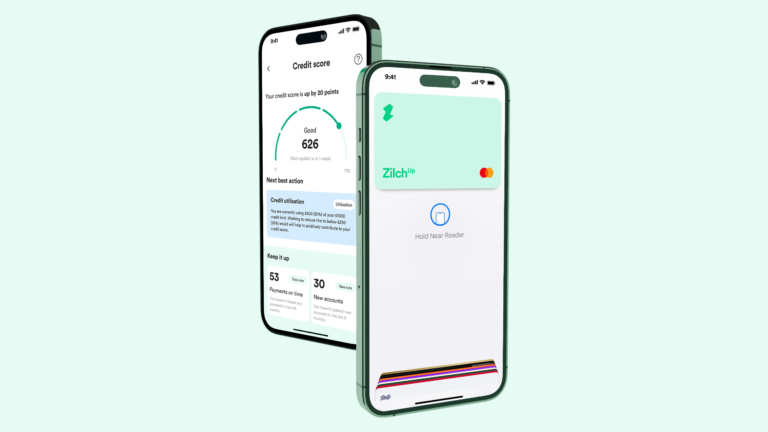

ZILCH UK - APPLY HERE

Pay over 6 weeks or 3 month

Zilch has been around since 2018 with one goal in mind – to get people the credit they deserve. Zilch is a virtual card that lets you pay for your purchases in three different ways, so you can use it like a debit card and earn a part of your purchase back in Rewards, or you can use it like a credit card and pay for things over 6 weeks or 3 months.

Zilch is strictly speaking not a secured credit card , but a Buy Now Pay Later (BNPL) virtual Mastercard. What makes it unique is that you can use it to shop at any retailer online or offline that accepts Mastercard – rather than being tied in to partner stores.

Pros:

- £5 Welcome Bonus

- Zero fees on purchases if you keep to repayment schedule

- Can improve credit

- Zero fees on purchases if you keep to repayment schedule

- You can use ZILCH without the credit by paying in full

- Improves Cash Flow

Cons:

- Zilch Anywhere incurs fees and is best avoided

- Refunds can take time to process

- Not recommended for those who find credit difficult to manage

- Non payments will incur fees and affect your credit rating – however obviously this is the case for any non payment

- Requires an application and credit file search

- Is not a secured credit card but a BNPL card

There are essentially two ways to use Zilch. You can Pay in 4, or Pay in 1 and earn 2% cashback.

If you choose to Pay in 1, you'll receive 2% back in rewards.

If you make a purchase and reach the checkout, if your amount is more than your available spend, it will be added to your first payment at checkout. The rest will be paid over six weeks.

You can use Zilch Rewards any time you want by simply choosing Zilch Rewards before you enable your card. The rewards will then be put towards your next purchase.

When you pay in full or refer friends, you'll be rewarded. With Zilch Rewards, you can use your rewards toward your next purchase, or save up for something special.

If you need more time to make a payment, you can tap on 'Snooze' and you'll be given four more days to make your payment. Keep in mind that the Snooze function incurs a small fee.

Here are some features of using a Zilch account:

Pay zero interest. Purchases through Zilch are interest-free.

Pay in 4. You can spread your purchases in four equal payments.

Zilch Anywhere. An upgrade that allows some customers to pay with Zilch at a long list of brands it has partnerships with, as well as those it doesn't, as long as they accept Mastercard. In this case, a £2.50 fixed fee will be charged.

No charges for early repayment. There are no fees for making early repayments on your Zilch account.

ZORRZ™ Secured UK Card - APPLY HERE

Low 12.50% APR - No Credit Cecks

The ZORRZ™ BlueAccess™ card – The only real secured UK credit card without any credit checks or application. Similar to the ZILCH card this is a virtual only Mastercard. This card is due to be launched soon and you can now subscribe on their website.

A secured card with no annual fee and the ability to earn rewards and much more.. ZORRZ BlueAccess is more a lending platform. This is a to order only card, meaning there is no application and rejection with a lot of additional perks like a rewards program, a Marketplace, BNPL payment option, just to name a few. The ZORRZ BlueAccess Mastercard can provide a way forward for those needing to build their credit profile or improving it, without the fear of being rejected.

Pros:

- No annual fee

- Very Low 12.5% APR on open balances

- Cash back rewards earning, a Marketplace with discounts and offers is uncommon for a secured card

- Free Credit Score access within the App.

- AI support, BNPL flexible payment options and zero environmental impact being a virtual only card are also some of the important features of this card.

Cons:

- After the initial 30 day trial period the Marketplace is accessible for a monthly fee of £4.99

- The ZORRZ BlueAccess card is not available yet.

- No credit score required to apply.

- No rejection, the card APP can simply be downloaded and used after your bank account has been connected through open banking.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a collateral deposit, and your credit line will equal your deposit amount, starting at £50. Your UK Bank current account must be connected when making your deposit.

- Automatic reviews starting at 9 months to see if they can transition you to an unsecured card.

- Earn cash back automatically. Plus get offers, discounts and other perks through the ZORRZ Marketplace.

Secured Card in Europe

Unfortunately currently not available

We have only being able currently to identify the ZORRZ BlueAccess card as the only genuine, secured ( collateralized ) credit card, which will only be offered currently in the UK ( this might change in the near future ).

US Credit Cards

UK/ EU Secured Credit Cards

Up to 3% Reward Rate

Earn 3% cash back in the category of your choice: gas and EV charging, online shopping, dining, travel, drug stores or home improvement and furnishings; Earn 2% cash back at grocery stores and wholesale clubs; Earn unlimited 1% cash back on all other purchases. You'll earn 3% and 2% cash back on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter, then earn 1%

A secured card with no annual fee and the ability to earn rewards, this Bank of America card can provide a way forward for those needing to build their credit profile.

Pros:

- No annual fee

- Cash back rewards earning is uncommon for a secured card

- Free FICO score access each month

- Cashback Match doubles cash back rewards earning at the end of the first year

Cons:

- Bonus category rewards are capped

- Secured cards don’t provide many of the perks unsecured cards do

- Secured cards require refundable deposits

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

UK/ EU Secured Credit Cards

Up to 3% Reward Rate

Earn 3% cash back in the category of your choice: gas and EV charging, online shopping, dining, travel, drug stores or home improvement and furnishings; Earn 2% cash back at grocery stores and wholesale clubs; Earn unlimited 1% cash back on all other purchases. You'll earn 3% and 2% cash back on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter, then earn 1%

A secured card with no annual fee and the ability to earn rewards, this Bank of America card can provide a way forward for those needing to build their credit profile.

Pros:

- No annual fee

- Cash back rewards earning is uncommon for a secured card

- Free FICO score access each month

- Cashback Match doubles cash back rewards earning at the end of the first year

Cons:

- Bonus category rewards are capped

- Secured cards don’t provide many of the perks unsecured cards do

- Secured cards require refundable deposits

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

UK/ EU Secured Credit Cards

Up to 3% Reward Rate

Earn 3% cash back in the category of your choice: gas and EV charging, online shopping, dining, travel, drug stores or home improvement and furnishings; Earn 2% cash back at grocery stores and wholesale clubs; Earn unlimited 1% cash back on all other purchases. You'll earn 3% and 2% cash back on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter, then earn 1%

A secured card with no annual fee and the ability to earn rewards, this Bank of America card can provide a way forward for those needing to build their credit profile.

Pros:

- No annual fee

- Cash back rewards earning is uncommon for a secured card

- Free FICO score access each month

- Cashback Match doubles cash back rewards earning at the end of the first year

Cons:

- Bonus category rewards are capped

- Secured cards don’t provide many of the perks unsecured cards do

- Secured cards require refundable deposits

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.